how are 457 withdrawals taxed

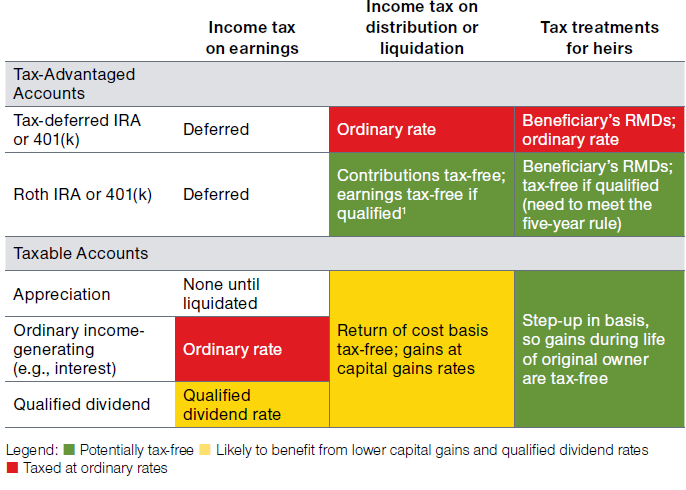

All distributions from IRAs 401ks 403bs and 457 accounts are subject to income taxes at ordinary income tax rates except Roth accounts assuming all requirements are met and any funds contributed on an after-tax basis. When the participant retires and starts to take distributions from their account those distributions are taxed as regular income.

401k withdrawals are taxed the same way the income from your job is taxed.

. If you withdraw funds from your annuity before the age of 595 you will likely owe a ten percent penalty on the taxable portion of the withdrawal. There is no set tax applied to 401k withdrawals. Early withdrawals A plan distribution before you turn 65 or the plans normal retirement age if earlier may result in an additional income tax of 10 of the amount of the withdrawal.

The amount you wish to withdraw from your qualified retirement plan. The only difference is there are no withdraw penalties and that they are the only plans without early withdrawal penalties. Generally the amounts an individual withdraws from an IRA or retirement plan before reaching age 59½ are called early or premature distributions.

Thats because they already were taxed when they were contributed. The amount you wish to withdraw from your qualified retirement plan. Plans of deferred compensation described in IRC section 457 are available for certain state and local governments and non-governmental entities tax exempt under IRC Section 501.

Early withdrawalsthose that happen before age 59½from any qualified retirement account. Plans eligible under 457 b allow employees of sponsoring organizations to defer. How is 457b taxed.

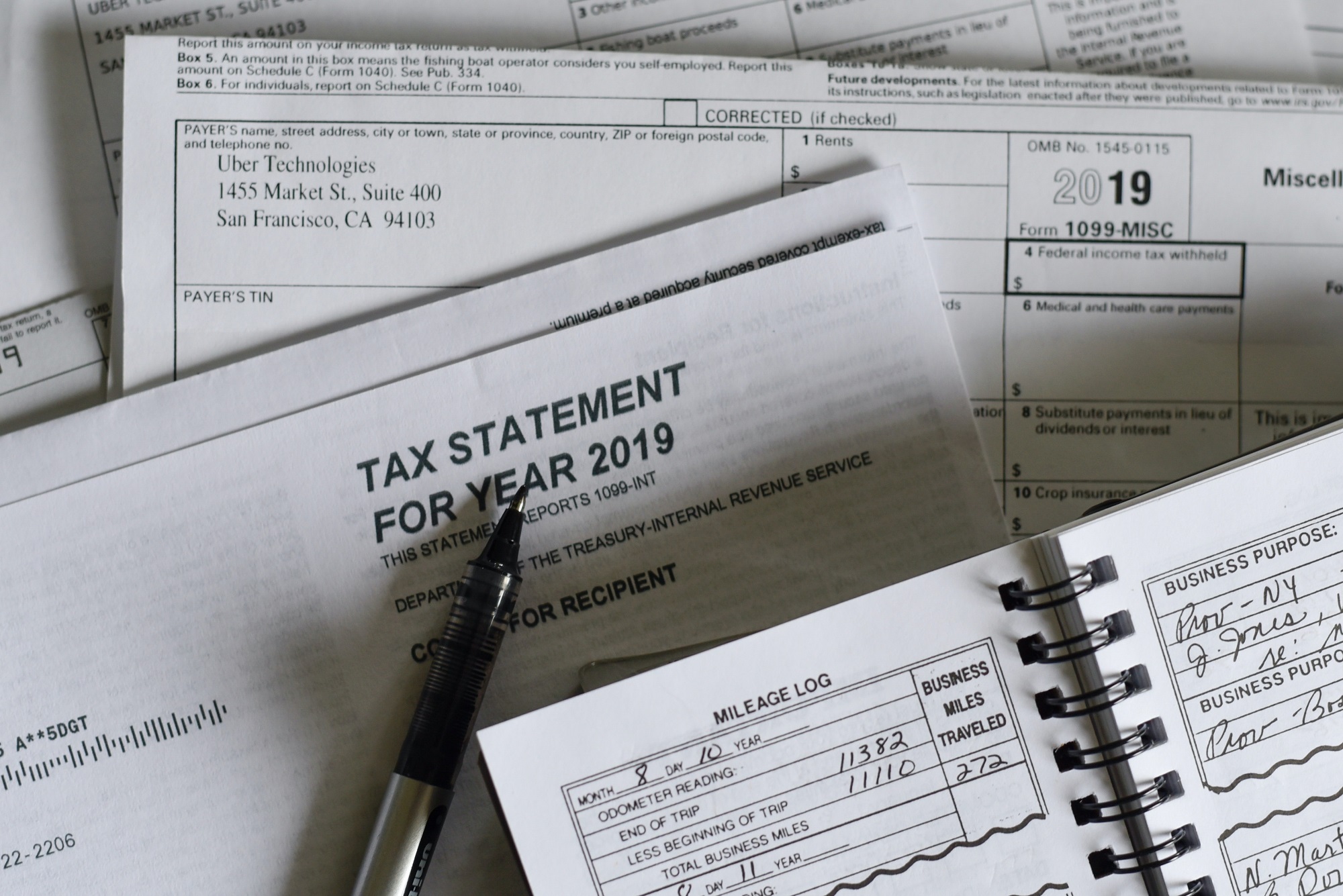

If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal. There is actually nothing basic about retirement withdrawals. When you begin to receive distributions they will be reported on Form 1099-R.

NJ taxes public retirement plan contributions health insurance Flexible Spending Health Savings Accounts and more. And of course the earnings from the 401k contributions are not earned income and thus are. You wont pay taxes on qualified Roth IRA withdrawals.

If you made contributions that were subject to income taxes you may not owe taxes on the entire withdrawal. The timing of withdrawals can also impact your taxes on annuity payments. Withdrawals are subject to income tax.

Youll pay tax on traditional IRA withdrawals. For this calculation we assume that all contributions to the retirement account were made on a pre-tax or tax-deductible basis. Here is a list of the key rules.

If you have access to one you may also have access to a defined benefit pension plan. For this calculation we assume that all contributions to the retirement account were made on a pre-tax or tax-deductible basis. Is a 457 pre or post tax.

All distributions from IRAs 401 ks 403 bs and 457 accounts are subject to income taxes at ordinary income tax rates. Most retirement plan distributions are subject to income tax and may be subject to an additional 10 tax. Because its supposed to be taxed you cant really avoid this.

If the account was held for less than five years any withdrawals from the account would be taxed as ordinary income. After that age withdrawals of lump sums rather than the regularly scheduled payments will trigger taxes on the earnings. Key Takeaways Contributions to conventional IRAs are tax deductible earnings develop tax free and.

How are retirement fund withdrawals taxed. A 457b is an example of a defined contribution plan. IRA withdrawals are considered early before you reach age 59½ unless you qualify for another exception to the tax.

They can be either eligible plans under IRC 457 b or ineligible plans under IRC 457 f. If you are a surviving spouse of the deceased IRA owner you can treat the inherited IRA as your own account and make withdrawals based on your life expectancy. Ad_1 In basic early withdrawalsearlier than age 59½from any sort of certified retirement account equivalent to IRAs and 401okay plans include a 10 penalty in addition to any revenue taxes due though there are some exceptions to this rule.

The money in a 457b grows tax-deferred over time. My question was related to 457 withdrawals which generate a 1099-R for tax season. 457 plans are taxed as income similar to a 401k or 403b when distributions are taken.

You are permitted to withdraw money from your 457 plan without any penalties from the Internal Revenue Service no matter how old you are. Withdrawals are subject to income tax. Everyone with a 457 b or 403 b is taxed for NJ purposes.

Section 1457-4a provides that in the case of a 457b plan maintained by a tax exempt entity annual deferrals that satisfy the requirements of paragraph b relating to the deferral agreement and paragraph c relating to the maximum deferral limitations are excluded from the gross income of a participant in the year deferred or contributed and are not includible. But with a Roth IRA there is no tax due when you withdraw contributions or earnings provided you meet certain requirements. The way individual retirement account IRA withdrawals are taxed depends on the type of IRA.

If the person tax 401k withdrawals and still works a job both income sources will be used to calculate the appropriate tax rate. But you also have the option of rolling the assets in an IRA rollover. The tax rate that is applied to 401k withdrawals includes all income throughout the year.

401k withdrawals early or otherwise are not subject to FICA or Medicare taxes.

Retirement Income Calculator Faq

Crypto Tax Free Countries 2022 Koinly

What Is Fica Tax Understanding Payroll Tax Requirements Freshbooks Resource Hub

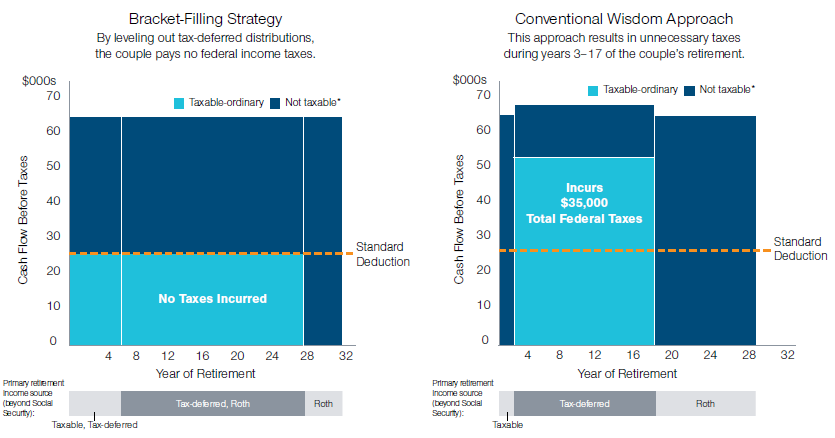

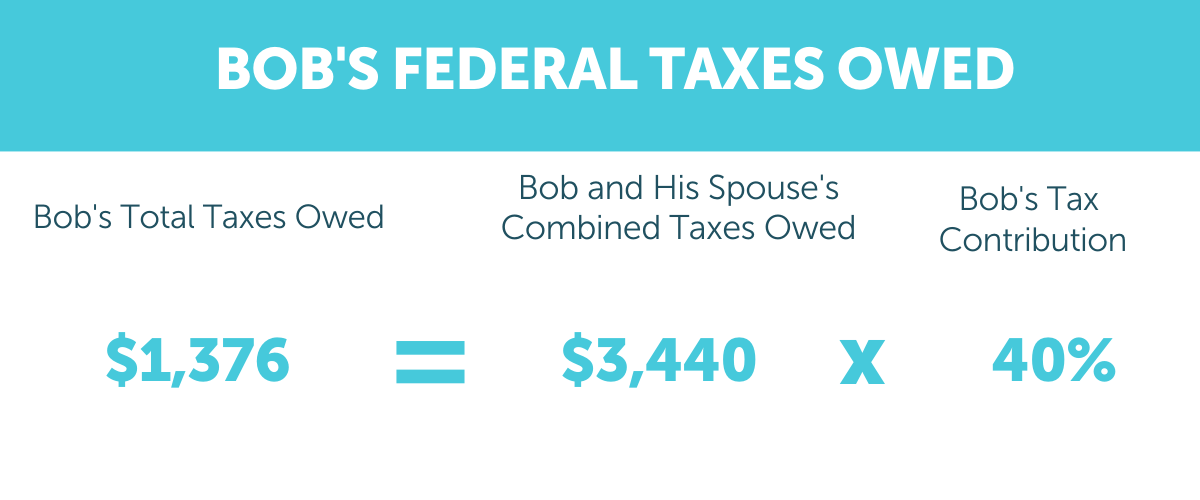

The Most Tax Efficient Sequence Of Withdrawal Strategy Explained Tan Wealth Management Certified Financial Planner Cfp San Francisco Advisor

A Tax Savvy Approach To Help Make The Most Of Your Retirement Income T Rowe Price

Qualified Vs Non Qualified Retirement Plans

401 K Inheritance Tax Rules Estate Planning

What Are Defined Contribution Retirement Plans Tax Policy Center

Ownership Of Iras And 401k Plans By Canadians

Pre Tax And Post Tax Deductions What S The Difference Aps Payroll

Taxes In Retirement Three Tax Planning Tips

The Hierarchy Of Tax Preferenced Savings Vehicles

How To Make Your Retirement Account Withdrawals Work Best For You T Rowe Price

Tax Deferral How Do Tax Deferred Products Work

5 Tax Savvy Retirement Withdrawal Strategies Apprise Wealth Management

/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)